Home equity refers to the portion of your home you own outright. Read on for everything you need to know about home equity.

A home is more than just a place to live. It’s also a valuable financial asset, and the key to unlocking its value is through home equity. But what is home equity, and how does it work?

Simply defined, home equity is the value of your home minus what you still owe on your existing mortgage. It’s the portion of your home that you truly own, and its value can be excavated to your advantage.1

In this guide, we’ll explain how to calculate and build your home equity, as well as how to leverage it for things like home improvements or unexpected expenses. We’ll also discuss specific ways to take equity out of your home and the risks and benefits of doing so.

Home equity is like a long-term investment, and its value is primarily affected by two factors:

To answer the question of what is home equity, one must grasp the interplay between these two forces. If your mortgage is a fixed-rate loan, then the impact of your mortgage payments is simple to calculate over time—every month, you make the same payment amount, which gradually shifts between paying down your interest and the loan principal.

Home value, on the other hand, has the potential to be more volatile when there are major changes in the national or local economy along with a range of other factors that impact how much your home is worth at a given time (aka, current market value).

In the United States, homeowners have over $32 trillion in equity, which is an average of $299,000 per household. Understanding the dynamics of mortgage payments and home value can help you leverage your home equity through loans, credit lines, or innovative solutions like home equity agreements and leasebacks.

So, what is home equity worth in your case? Thankfully, calculating it is fairly straightforward; simply take your home’s value and subtract what you still owe on the mortgage. The remaining amount is your home equity.

Let’s consider an example to illustrate how to calculate home equity:

Of course, this is a simplified example. Determining the current market value of your home might require you to hire a professional appraiser—which is actually a requirement if you’re seeking a home equity loan.2

For a quick approach, enter your address into a few different free online home valuation estimators such as Realtor.com, Zillow, and PennyMac and average the results.3,4,5 You can also research recent sales of similar homes in your area or request a comparative market analysis (CMA) from a real estate agent.

Building home equity paves the way for increased borrowing power as your percentage share of ownership against the lender grows.

While there are many ways to build equity in a home, here are five tried-and-true strategies:

General home maintenance helps you preserve the worth of your property—letting it fall into disrepair is a surefire way to deplete its value. In addition to routine upkeep, taking extra steps to invest in your home through strategic renovations and improvements makes it nicer for you, the homeowner, and boosts its market value. And, increasing your home value leads to increased equity.

Before you choose projects that reflect your taste, lifestyle, and family needs, however, make sure they don’t compromise your property value. While a home library may serve you better than a guest room, converting closet space to built-in bookcases means you’re down one official bedroom—a definite downgrade to your property value.

Look for opportunities to enhance your use and enjoyment of your home and raise your property value at the same time. For instance, according to Remodeling’s 2024 Cost vs. Value Report, these three projects will more than make up for the average cost of materials and labor to complete them:6

Other high-yield projects include adding a fiberglass grand entrance (97.4% recouped), a minor kitchen remodel with midrange fittings (96.1% recouped), siding replacement (88.4% recouped for fiber-cement, 80.2% for vinyl), and the addition of a wood deck (82.9% recouped).

Paying your mortgage installments on time is more than just a financial responsibility; it’s a savvy way to expedite the growth of your home equity. Since mortgages reflect the lender’s equity and subtract from your total home equity, each timely payment inches you closer to full ownership.

Plus, on-time and in-full mortgage payments are an excellent way to boost your credit score, which can help you secure a lower interest rate if you apply for loans against your equity in the future.

Most American homeowners have a 30-year mortgage loan. But to build and access equity sooner, it’s possible to opt for a shorter-term loan, which can also save on interest payments.7

With a shorter-term loan, you can expect to pay a higher monthly mortgage payment—but if you can make it work within your budget, you’ll save big on total interest paid in addition to building your equity more quickly. For example, consider these monthly payments and total interest cost differences by varying the term of a $300,000 mortgage at the same 5.0% fixed interest rate:

While no one can predict the housing market, historical data shows that homes tend to appreciate in value over time.8 The rate of home appreciation varies between sources—according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index reported by the Federal Reserve Bank of St. Louis, the average annual rate is 4.8% based on price changes 1997 and 2023.9,10

However, year-over-year appreciation can jump to double digits in hot neighborhoods, when interest rates drop, and when demand is higher than supply. Check out the HPI Calculator from the Federal Housing Finance Agency to look up the average interest rates for your state and metropolitan area.11

Since equity is tied to your home’s market value, simply owning the home over time can potentially increase your pool of equity.

Your regular monthly mortgage payments are split between paying off your interest and your loan principal—with significantly more going toward interest in the beginning. You can speed equity growth (and slim down your total interest cost) by making extra payments applied solely to your loan principal if your lender allows it.

Consider using occasional or non primary income sources to pay down your principal, such as:

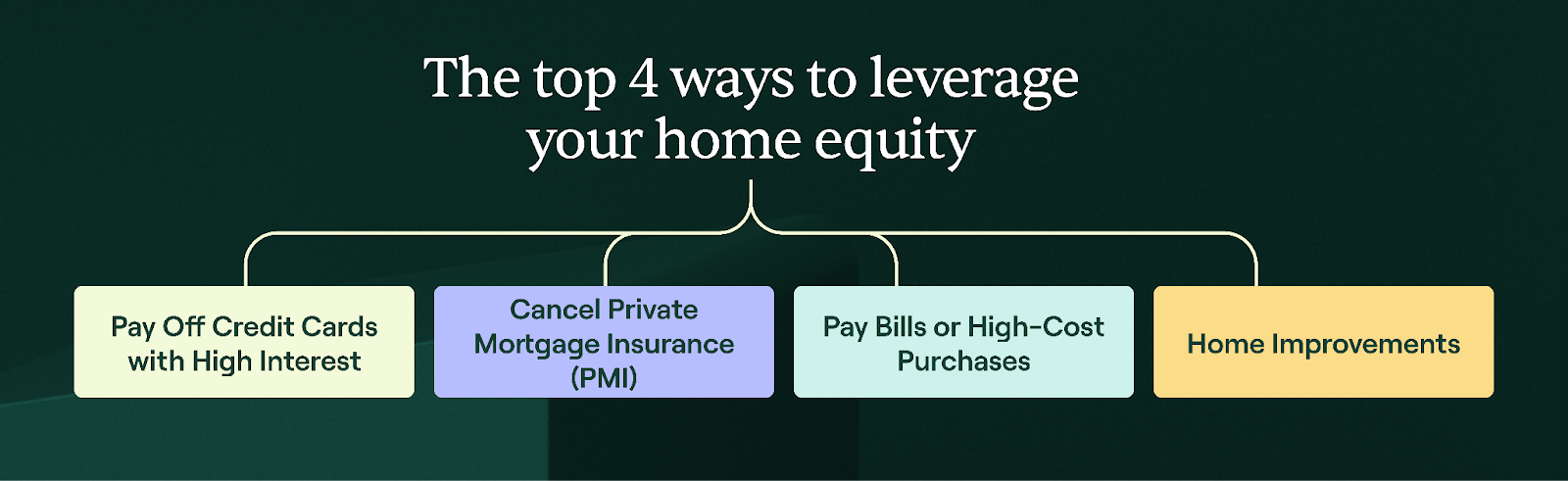

Now that we know the answer to what is home equity, how to calculate it, and how to build it, you might be wondering: What can home equity do for me?

From debt consolidation to covering unexpected expenses, let’s talk about a few clever ways to leverage home equity.

Pay Off Credit Cards with High Interest

Credit cards often carry high interest rates, averaging 27.62% as of July 2024.12 And juggling multiple payments can be confusing and overwhelming.

Home equity can help you consolidate these balances into a single loan with an interest rate averaging 8.6%.13 This cuts interest payments and simplifies your financial obligations.

If you purchased your home with a down payment of less than 20%, you will likely pay for PMI as a means to protect the lender. Depending on your credit score, PMI costs an average of 0.46–1.5% of your loan amount per year.14 For a $300,000 loan, that means paying $1,380–$4,500 per year for something that offers you no tangible benefit.

However, once your home equity increases to 20%, you can request to cancel your PMI, lowering your monthly mortgage payments.

Need to cover significant expenses like home repairs, medical bills, or college tuition? Leveraging home equity may help you unlock the funds you need.

Home equity loans or a home equity line of credit (HELOC) give you access to a lump sum or revolving credit line. These funds are based on your home equity and can help finance important expenditures.

While home improvements can build your equity, it’s also possible for your home equity to fund home improvements.

Funding renovation projects can be a smart way to leverage equity since they can be eligible for tax deductions if they qualify as substantial improvements and meet other IRS guidelines. This means you can’t take a deduction just to make simple repairs or minor tweaks, but you can if your project meets one of these goals:15

Now that we understand what home equity can do, how can we transform that accumulated value into something tangible?

Here are five ways to access your home equity.

What is a home equity loan? This loan option allows you to borrow a lump sum of money based on the equity you have in your home. Here’s a quick rundown:

Since home equity loans have a fixed interest rate that’s typically lower than a credit card or personal loan, they can be a flexible financial tool to leverage equity. For example, you can use the home equity loan for a remodel or to purchase new appliances.

A home equity line of credit (HELOC) is a revolving line of credit that allows you to borrow against your home equity, much like a credit card. Here are a few key points:

HELOCs are similar to home equity loans in terms of the application process, borrower requirements, and average rates. However, HELOCs tend to have less overall cost since homeowners only pay interest on the amount borrowed during the draw period.

This option combines features of home equity loans and HELOCs. Here’s a quick summary:

Whereas regular HELOCs have a variable interest rate, this fixed-rate variant can provide predictable monthly payments during the repayment stage after only paying interest on what you borrow during the draw period.

What is a cash-out refinance? A cash-out refinance is another loan option that allows access to a lump sum of your equity. Here’s how it works:

To clarify, unlike a second mortgage, cash-out refinancing replaces your old mortgage rather than creating another monthly payment. However, there are additional fees to be mindful of, such as higher closing costs.16

A sell and stay transaction is an intriguing way to get equity out of your home without refinancing. This method allows you to unlock your hard-earned equity without having to move out or take on more debt. Here’s what you need to know:

Since the new owner often takes care of essential repairs, property tax, and property insurance, a sell and stay transaction can be an attractive option for those who want to access more of their home’s equity while continuing to live there.

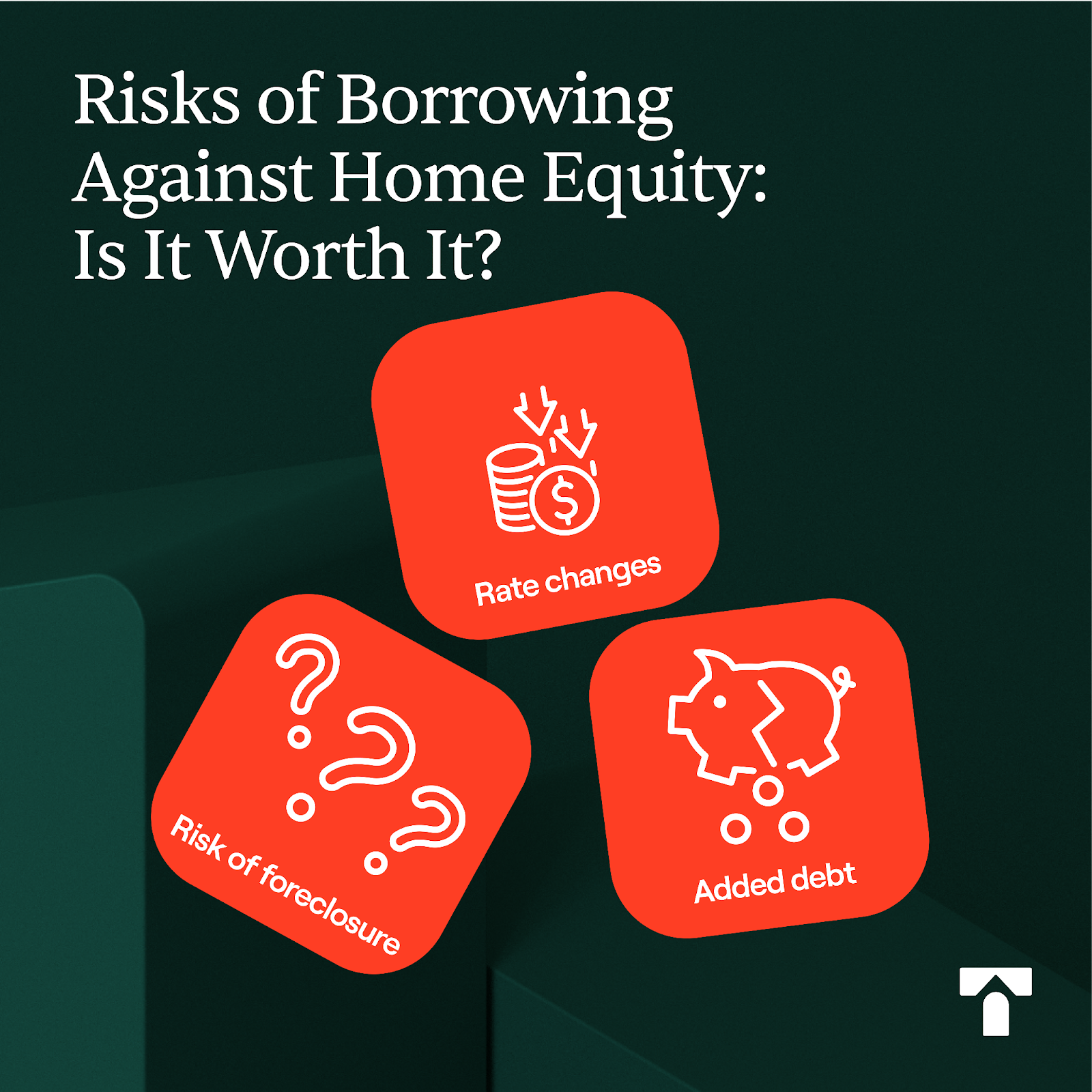

Whether using your home’s equity is worth it or not depends on your situation. In general, it’s not advisable to cash out on home equity for unnecessary expenses, vacations, or depreciating assets like cars or boats.

Since most equity-accessing options create debt (or shift it around), overusing it carries risks such as:

You've worked hard as a homeowner to build up equity in your house. It's now time to put that equity to work for you.

Truehold’s sell and stay transaction allows you to sell your home and then rent it back. It offers a unique opportunity to access your home equity—no hidden fees, no penalties, and it’s not a debt.

What can you expect with our sell and stay transaction?

Whether you’re seeking to invest in new ventures, optimize for retirement, or simply have more financial flexibility, our team of professionals are committed to helping you access your home equity and live easier in your own home.

Explore our FAQ page and connect with a Truehold representative to get started today.

Sources:

Chat with a real person & get an offer for your home within 48 hours.

Call (314) 353-9757